New TOTAL Store tool makes it easy to modify land development components

Written by a la mode on February 17, 2016

This is a guest post from Alan S. Kiene, a real estate appraiser since 1980. He is an SRA member of the Appraisal Institute, an Ohio Certified General Appraiser, and holds real estate licenses in Ohio and Florida. He graduated from Ohio State University with a B.S.B.A. and the University of Akron with an M.B.A. in Finance. Active in the land development business since 1997, he is the President of Spring Glen Development Company and Vice President of Medina County Real Estate Company.

Real estate appraisers are naturally interested in land value. It is, after all, at the crux of highest and best use analysis. And what appraiser has not been asked to estimate the value of development land?

The Land Development Model is a powerful, easy to use, and inexpensive tool that:

- Can be used to estimate, support, or extract land value;

- Extends analysis beyond "gross profit" to "profit before tax," resulting in an interest cost calculation based on the cumulative effect of multiple land development components;

- Allows for quick and easy "what-if" analysis on all development components;

- Estimates the profitability of single and multi-phase land subdivisions at once; and

- Can be used to develop pro forma financial statements.

The Land Development Model (or "LDM") can analyze phases up to three phrases at once or an unlimited number of phases one phase at a time. Project duration can be as long as ten years. Given the model's capacity for "what-if" analysis over the full spectrum of land development components, combined with its Excel functionality, any number of related project scenarios and associated model results can easily be produced, compared, and saved under distinct filenames.

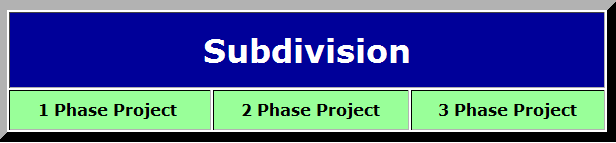

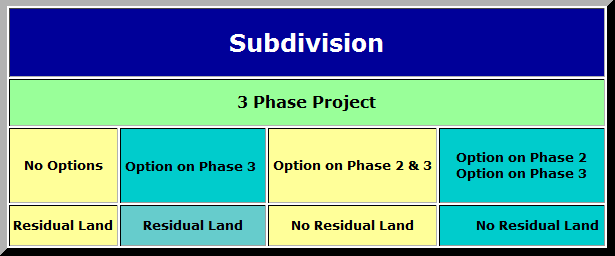

The LDM can handle one, two, or three phase subdivisions at once. Two and three phase projects will involve the use or non-use of real estate options, the result of which is the presence or non-presence of residual land. Number of phases and real estate options are two of the land development components, so decisions and negotiations made relative to these components have an effect on project profitability.

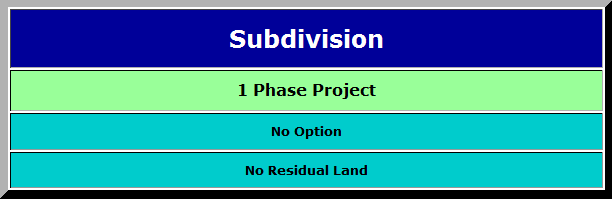

A one phase subdivision is the easiest project type to model. Land options and residual land are non-issues. The developer simply purchases vacant land, improves the land, and sells lots.

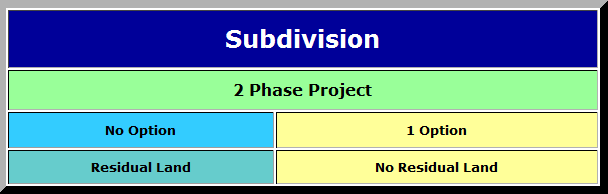

A two phase subdivision is more complex because it involves a land option or residual land, but not both. If there is no option, the developer purchases all the land up front. The land to be developed in the future phase two is residual land.

If a land option for the phase two land is negotiated between the developer and landowner, the developer has the option to purchase the phase two land sometime in the future. In this case there is no residual land or carrying cost because the land for phase two is still owned by the landowner.

Generally the developer prefers to have an option. If the economy unexpectedly declines, phase one goes poorly, or the option holder decides for any reason not proceed with the future phase or phases, the developer has no obligation to purchase the land. The option money will be forfeited however.

Land options can be good for the landowner as well. He or she may not want all the cash in a single tax year, preferring instead to defer income to future tax periods. Consequently the value of the option can be an issue. Using 'what-if' analysis on the land development component project type, the model can be used to estimate option value. This seller strategy regarding taxes is also relevant in the analysis of seller financing, which is one of the components incorporated in the LDM.

A three phase subdivision is the most complex project type to model because it can have multiple combinations of option/no option, residual land/no residual land. There can be no options with residual land (column 1), there can be an option with residual land (column 2), an option with no residual land is possible (column 3), and there can be multiple options and no residual land (column 4).

Again, "what-if" analysis on the land development component project type can provide an idea of option value. It follows that the greater the number of phases, the more important options become.

_______________________________________________________________________________________

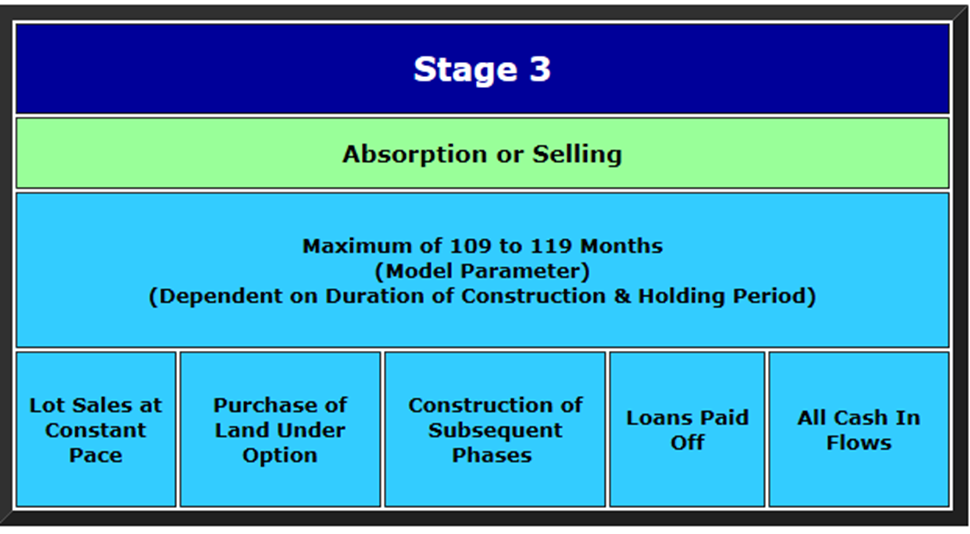

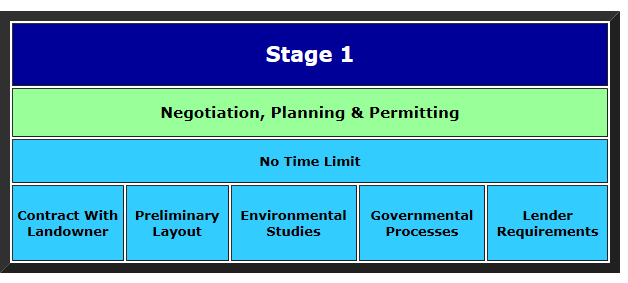

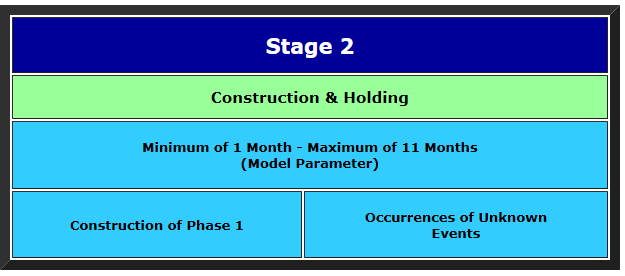

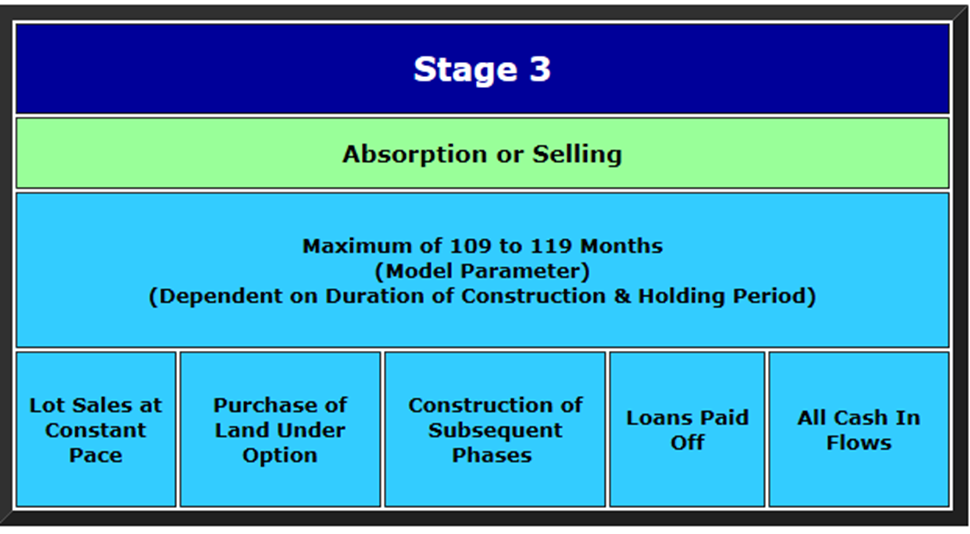

The land development process involves three distinct and progressive stages. I refer to them as (1) the "negotiation, planning, and permitting" stage; (2) the "construction and holding" stage; and (3) the "absorption or selling" stage. All things being equal, the longer the project, the less profitable the project. The model recognizes and measures timeline concepts inherent to land development.

________________________________________________________________________

The model allows you to easily modify these variable land development components, singly or in combination, to calculate the effect on interest cost and profitability and to estimate, support, or extract land value:

- Number of Phases

- Number of Lots

- Land Cost

- Land Purchase Options

- Sale Price of Lots

- Sale Costs

- Development Cost

- Builder Deposits

- Permitting Cost

- Construction and Holding Period

- Absorption Rate

- Interest Rate on Loan

- Lender Requirements

- Seller Financing

The LDM will help you consider, analyze and answer many questions about land development, such as:

- Is the project best suited as a single or multi-phase subdivision?

- What is the effect of purchasing all the land up front versus securing an option or multiple options on the land to be developed in future phases?

- How much interest can be saved if real estate options can be obtained?

- Is the project feasible if seller financing is not available?

- What is the effect of builder deposits on total interest cost?

- How does the time taken to install the infrastructure affect profitability?

- What is the lender’s maximum loan percentage for the project?

- What percentage of gross revenue does the lender require to be applied to loan reduction as lots are sold?

- In the case of a multi-phase subdivision, what is the lender’s maximum loan percentage on the active phase and, if the future phases are not optioned, what is the lender’s maximum loan percentage on residual land?

- What is the cash requirement for the developer or investor based on lender requirements and the availability of seller financing?

- How does absorption affect total interest cost and consequently project profitability?

- How do variable lot prices and variable development costs in multi-phase projects affect overall profitability?

- Since development loans are tied to a monetary benchmark such as the prime rate, what is the effect on profitability in stable, increasing or decreasing interest rate environments?

- What is the most that can be paid for development land given pre-determined investor profit criteria such as percentage of gross profit and average return on equity?

The LDM provides a single input page upon which entries to input fields generate output tables and schedules such as annual profit and cash flow tables, profit per phase tables, a project summary table, a lot sale schedule, an interest calculation page, a cash inflow page, a key variables page and a tax calculation page.

__________________________________________________________________________

A basic understanding of development components and the timeline concept inherent to the land development process will be helpful but not required. You do not have to be an expert. The LDM is useful to both the novice seeking to gain an understanding of the land development process and experienced practitioners looking for an easy-to-use land development tool.

Vist the TOTAL Store TOTAL Store for more details or to purchase the Land Development Model.