You built the website, now how do you get the leads to come?

Written by Nathan Thomas on August 19, 2004

You built the website, now how do you get the leads to come? Read more...

Written by Nathan Thomas on August 19, 2004

You built the website, now how do you get the leads to come? Read more...

Written by Nathan Thomas on August 19, 2004

There used to be a stigma attached to older adults - once they hit 55 they automatically bought mammoth trailers and spent their retirement years traveling the U.S. with no more mortgage worries or lawns to mow. Read more...

Written by Nathan Thomas on August 17, 2004

Value IT, the appraisal arm of a joint venture between origination giant Wells Fargo and First American, is changing its name as part of a corporate rebranding that will more closely identify Value IT's appraisal services with the title, credit and settlement services its sister organizations provide. Read more...

Written by Nathan Thomas on August 17, 2004

Many mortgage brokers know that they will have to work harder to keep the record volume of business they've enjoyed over the past few years now that interest rates seemed to be on their way up. In fact, according to a forecast from the National Association of Mortgage Brokers, the volume of mortgage lending is expected to drop 35 percent to $2.5 trillion this year, as refinances slow to about 42 percent of all loans, down from 66 percent in 2003. That's due to mortgage rates that have continued to move up after hitting a 41-year low of 5.23 percent in June 2003. The result? Finding customers with top-quality credit eager to refinance may not be so easy anymore and mortgage brokers may need to look to different markets than they're used to. Mexican-American market The Mexican-American market is now the nation's fastest-growing market – and many are in the market for a new home. An estimated 2.2 million Hispanic households, most of them of Mexican descent, could become homeowners by the end of the decade if real estate and lending professionals reach out to them, according to new research by the Tomas Rivera Policy Institute at the University of Southern California. The study of 1,400 renters and recent first-time buyers in the Los Angeles, Houston and Atlanta areas highlighted the obstacles that stand in the way for Latino home buyers and the opportunities for real estate professionals who venture into this market. For example, although the majority of those surveyed have lived continuously in the United States for more than a decade, many are confused about the legal requirements for establishing credit and obtaining financing, and believe they must be either naturalized citizens or legal and permanent residents to buy a house. Another barrier for Mexican-Americans is a lack of information. "For immigrants who speak little English, it is a daunting task to acquire information and to understand the complexity of the home buying process," the study said. "We found that prospective home buyers either have no information, or even worse, misinformation." The participants indicated they considered real estate professionals such as mortgage brokers, lenders and real estate agents trustworthy advisors in the homebuying process, opening the door for mortgage brokers to implement outreach programs for potential buyers. To foster ownership among Latinos, the study calls on real estate professionals to serve as trusted intermediaries by becoming part of the Latino community's support system. To help educate the large and growing Latino market, it recommends the creation of bi-lingual home buying and financial literacy programs and innovative mortgage products that ensure equal access to financing and protect unknowing borrowers from abusive lending practices. Read more...

Written by Nathan Thomas on August 17, 2004

At its 2004 Annual Convention last week, the California Association of Mortgage Brokers introduced the first definition for predatory lending that could become the model for the rest of the U.S. CAMB has defined predatory lending as "intentionally placing consumers in loan products with significantly worse terms and/or higher costs than loans offered to similarly qualified consumers in the region for the primary purpose of enriching the originator and with little or no regard for the costs to the consumer." A clear, universal definition of the practice may be the right conduit for stronger regulation and stricter penalties for predatory lending practices across the nation. Previous attempts to codify anti-predatory lending laws at the state level have been sporadic. In Georgia, mortgage lenders left the state in droves rather than face arcane penalties until the state legislature changed the law last year. However, Massachusetts was able to enact its Predatory Home Loan Practices Act (House Bill 4880) on Aug. 9. On the national level, five federal anti-predatory lending bills have meandered through Congress over the past two years and none of them have made it to the President's desk. Even the Office of the Comptroller of Currency has attempted to preempt state laws to prevent a patchwork of differing standards among banks. Whether or not the rest of the U.S. adopts the definition, CAMB seems to be taking a street-level approach to solving the problem that has plagued the mortgage industry for years and recently wiggled its way into the 2004 presidential campaign with both camps vowing to fight "unscrupulous real estate practices." Read more...

Written by Nathan Thomas on August 17, 2004

According to Asset Securitization Report, 15 percent of manufactured homes shipped in 2003, or 21,000 units, are in repossession inventory. Citing Standard & Poor's analysts, the report said two thirds of Asset Backed Securities (ABS) downgrades over the last 18 months are attributable to the manufactured housing sector; and 80 percent of ABS defaults during that time were on manufactured housing bonds. Read more...

Written by Nathan Thomas on August 17, 2004

Real estate is becoming more complex with each transaction bringing about the potential for more and more lawsuits. Real estate agents are increasingly finding themselves caught in the crossfire between buyers and sellers, making errors and omissions (E&O) insurance a necessity. Read more...

Written by Nathan Thomas on August 17, 2004

OKLAHOMA CITY, OK -- Independent mortgage broker Terry Silver of Jeffersonville, IN and Tersha Inc. was selected the winner of a la mode, inc.'s Rolex™ giveaway in a drawing of mortgage professionals who had tried a demo Mortgage XSite in conjunction with the launch of Mortgage XSites websites for mortgage professionals in June. Read more...

Written by Nathan Thomas on August 17, 2004

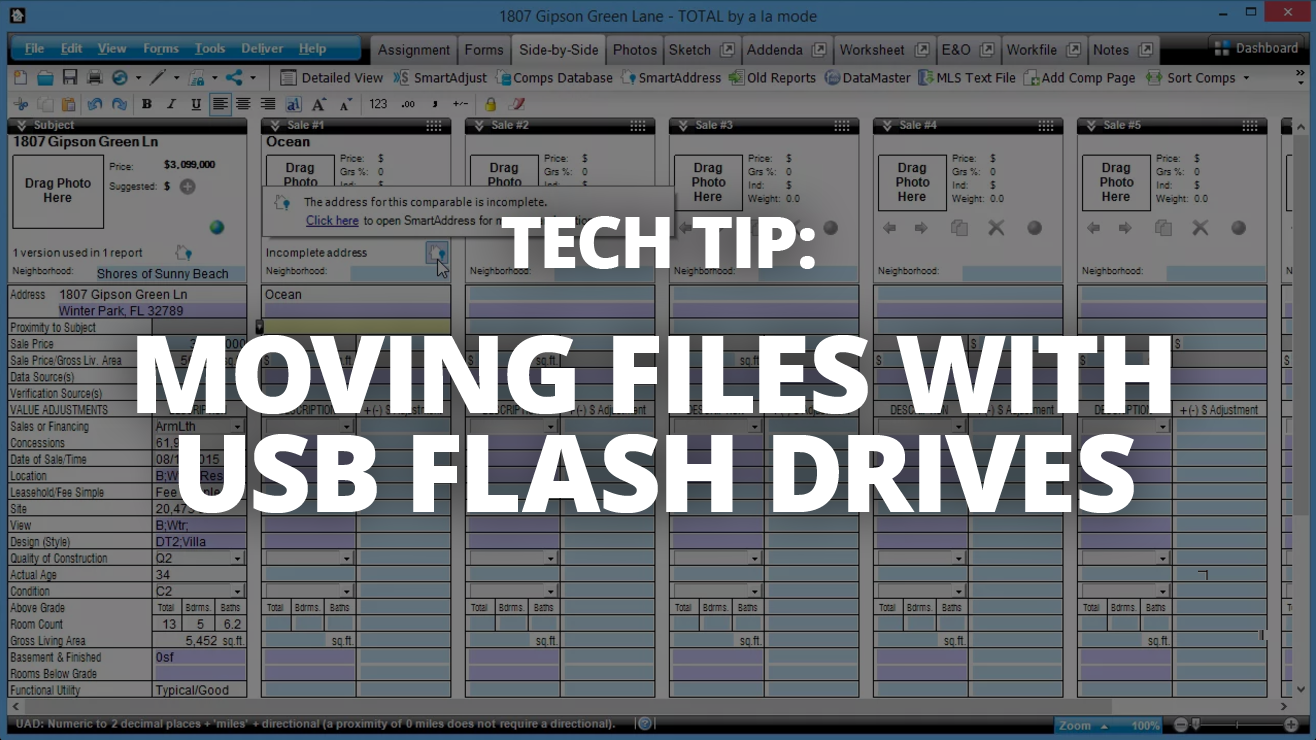

Productivity in the field has never been more important than it is today, with homebuying showing no signs of slowing - existing home sales increased at a record pace in the second quarter, the National Association of REALTORS® said. Read more...

Written by Nathan Thomas on August 17, 2004

Adjustable-rate loans (ARMs) are more popular than ever, even though today's low rates have almost nowhere to go but up, but homeowners who opted for this type of loan may be in for more mortgage than they can handle in the next few years. Read more...