As many of you know, we recently launched a new data validation tool called QuickSource, and we wanted to address one of the most common misconceptions we’ve heard.

As one appraiser put it, “I just don’t trust any 3rd party data. By the time I verify the automatic information [from QuickSource], I could have just input it myself.”

While importing data to your reports is one of the benefits of QuickSource, it’s far from the only one, and probably not the most impactful. And as far as verifying 3rd party data, that’s exactly what QuickSource helps you do. Compare it to how you were finding and checking data prior to QuickSource. From my perspective (coming from an underwriting and compliance background), the biggest game-changer QuickSource brings is the ability to quickly validate the data you’re using in your reports, all in one screen, to help you avoid revision requests. But why is that so important?

Well, let’s talk about revision requests.

No one likes additional questions coming back from clients on a report you’ve already completed and delivered. How many times have you gotten an email from a client days or weeks after you’ve submitted your appraisal, asking you to justify why you used specific comparable properties or telling you that a piece of data didn’t match what they’re seeing? Every time this happens, you’re spending more time on the report, but not being paid more. Depending on the severity of the revision request and if you’re able to justify your input, you also run the risk of getting “dinged” on your quality score with that specific client. That could affect the number of additional jobs the client offers you, and the amount you can charge them for your work. That could be a huge impact on your business!

No one likes getting questioned on their work, especially when you’re the one with the experience, expertise, extensive training, and have provided your in-depth analysis. So why do these requests happen? Let’s start with the Freddie Mac Seller/Servicer Guide Chapter 5601. (While I’m using the Freddie Mac guidelines for this example, these same requirements exist for all investors.)

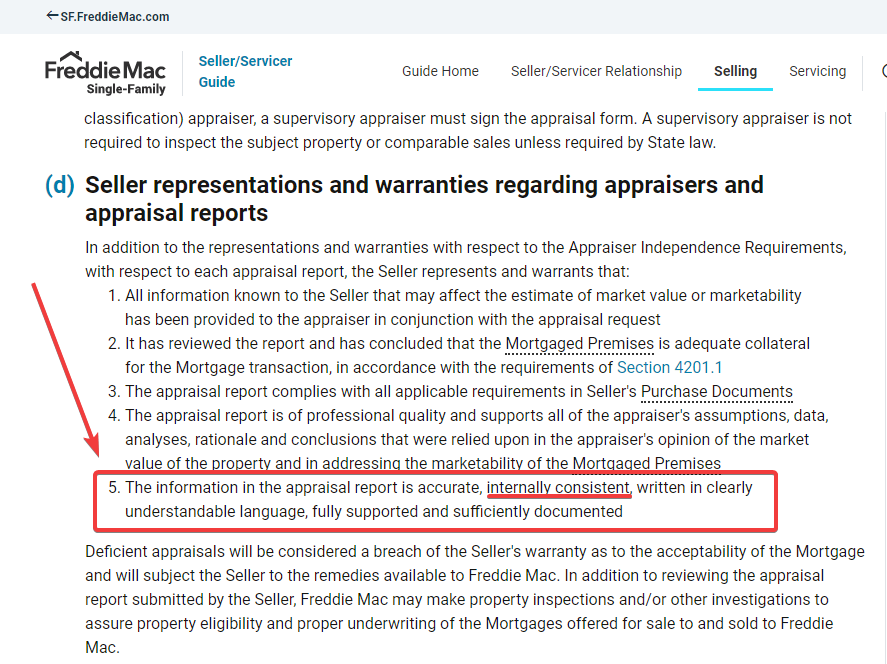

I’m using the “Collateral Review Requirements” section directly from the guide your clients and underwriters are accountable for when using your reports. Specifically, let’s focus on the area that states, “The information in the appraisal report is accurate, internally consistent, written in clearly understandable language, fully supported and sufficiently documented.”

Consider how long your clients, the large banks, lenders, and AMCs have been in business, and that many cover the entire United States. They’ve touched almost every property in America (likely multiple times), and during the majority of those transactions, they received an appraisal. The data from each and every appraisal is stored and becomes internal data that can be used to historically compare against the data you’re submitting. That’s what “internally consistent” means. Spoiler alert – your clients have access to ALL of the same information you do when creating your reports (and more). So, they’re liable for any discrepancies that aren’t justified, because it affects the opinion of value.

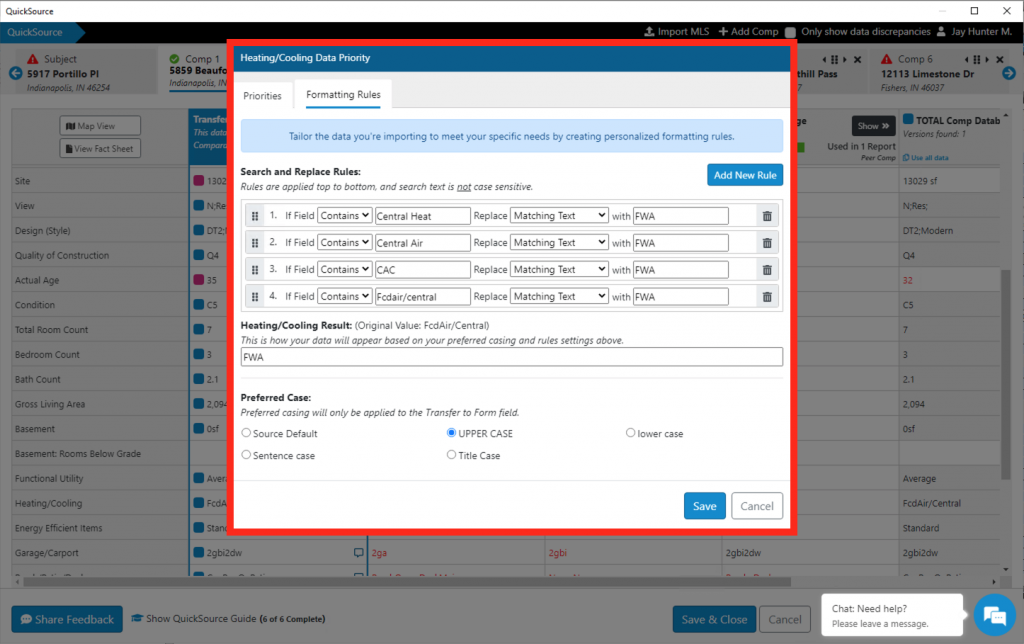

Before QuickSource, you were likely manually pulling up multiple websites (MLS, public records, etc.) to vet the accuracy of your data and deciding what to use, all on the fly. That leaves a lot of room for mistakes because each website has its own formatting and order, which don’t match field-to-field. Not to mention, they don’t all have the same fields available. Then, consider where that data originates. The answer is not appraisers. It comes from Tax Assessors, real estate agents, etc., who all have different views on what they consider essential, which is vastly different from how appraisers use that data. For years, we’ve heard you state that you don’t trust the available data. So, we researched the best ways to enable you to validate what is right. In QuickSource, we display EVERY data field for your comparables grid, from four different sources, side-by-side, in one screen. Then we indicate every data field that disagrees amongst those other sources by highlighting them in red. We want you to easily see every discrepancy so you can decide which data is right for your reports, without having to juggle multiple screens and websites. Plus, these discrepancies are likely to be what your client would flag and send back to you for revision requests. So why not comment on them ahead of time and avoid the revision?

For those who initially feel like they’re spending more time importing their data – that may be true, temporarily. This is a workflow change. You won’t be just importing data. You’ll be deciding the most accurate and appropriate data to send to your report. As you get more comfortable (learning a new tool), you’ll see your speed increase, but you’ll also eliminate the time you used to spend manually vetting your data in different stages of your workflow, and of course, the additional revision requests you could have received from your clients. We’ve also added multiple ways to build formatting, casing, and priority rules that will automatically customize your data so that it looks exactly like you prefer. That means, over time, you’ll see your process become faster and faster as you build out your rules. Just like it did back in the day when you were building and refining your QuickLists in TOTAL.

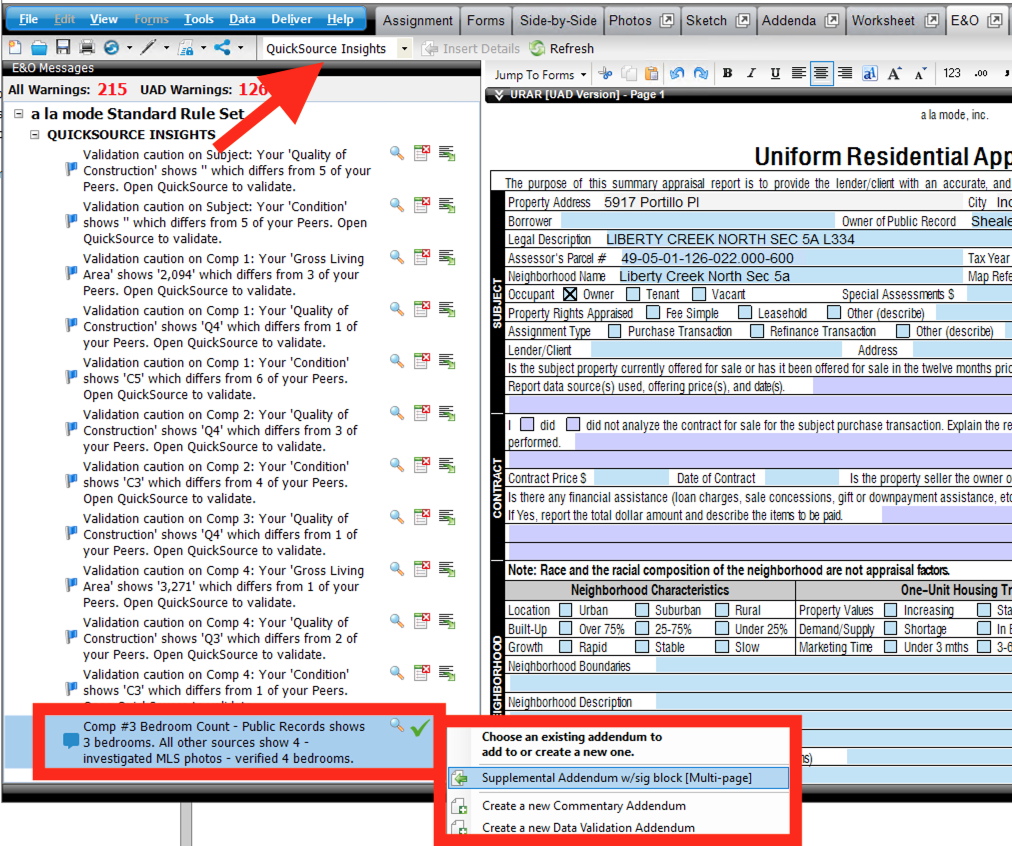

With QuickSource Insights, we’ve taken it another step further and enabled you to send “notes” from QuickSource to your E&O view in TOTAL. When reviewing your discrepancies in QuickSource, you’ll likely come across issues you’ll want to speak to in your addenda or remind yourself to take action on before delivering your report. By sending these notes to your E&O, you’re reminded of those items when you’re doing your final QC after you’ve refined your comps, added adjustments, and run through your reconciliation. From there, you can mark insights as resolved or send the commentary directly to the addendum of your choice. This gives you one more stop-gap measure to ensure you’ve documented commentary, justifications, and any discrepancies for your clients, so it doesn’t come back as a revision request later.

QuickSource is a very robust product, which may challenge the way you do things. We know that changing your workflow or learning a new tool can be daunting, especially when you’re not used to seeing all of this information in one place. Don’t worry; you’re not on your own. We’re here for you every step of the way. We host a large variety of training classes that you can attend live, recorded sessions to watch at your own pace, and a wealth of help documentation to use as you go. And if you’re Elite, don’t forget to use your unlimited Product Coaching!

Ultimately, QuickSource should help you produce better reports, in less time, that generate fewer revision requests and speed up your turn times, helping the entire industry.

More QuickSource resources

Live Training: See QuickSource in action and ask questions

Save $150: Purchase QuickSource during the launch period and save

Learn more: Find help docs, videos, user’s guide and more at help.alamode.com/quicksource

.png)

.png)

-1.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

-1.png)