This is a guest post from Woody Fincham, SRA. Find more of his writing about appraisal topics on his blog here.

I was looking for some inspiration to write this piece, which is my first attempt at doing something for the Appraisal Team Blog as a guest author. Rather than venture into something technical, I wanted to make a splash with something we all discuss in groups: appraisal fees, in particular those involving appraisal management companies (AMCs). Here in Virginia, we just passed a new law requiring AMCs to pay reasonable and customary fees. This piece of legislation is known as S.B. 1445. So this topic is on the mind of most valuation professionals in the Commonwealth presently.

It got me thinking about what we as appraisers all know, but sometimes forget: what really goes into an appraisal report. Every one of us that do this for a living understands it, but our clients really do not understand it. What is worse is that our state legislators rarely understand it at any level. If Virginia can pass something like this, then so can many other states. After doing some lobbying at the federal level and some locally within my state, I have found that an effective tool with elected officials is to use comparisons that they can identify. I have learned that most politicians love to eat, and most of the time, eat pretty well. So in light of that here is a contrast that may prove effective for them, and maybe for some of our colleagues within our own ranks.

Deconstruction: the BLT sandwich

One of the big trends in the restaurant sector is to take classic dishes or old favorites and present them as something new. This trend is known as deconstructing. Do you remember the old-standby sandwich, the BLT? Most everyone is familiar with the slices of good bacon, lettuce, fresh sliced tomato, on toasted sandwich bread and mayo.

Many chefs are taking this classic, and other well know recipes, and breaking the parts out separately as a presentation technique to showcase the old as something new. This highlights each ingredient, as well as adds some flare to what many may look at as something boring. All of a sudden, it is new again. Here is what one may look like:

The one thing that immediately becomes clear with this technique is that all the ingredients are out in the open. Marginal quality ingredients are not an option. Everything must be eye pleasing and taste good on a standalone basis, and meld well with the other ingredients.

Deconstruction: the Valuation Process

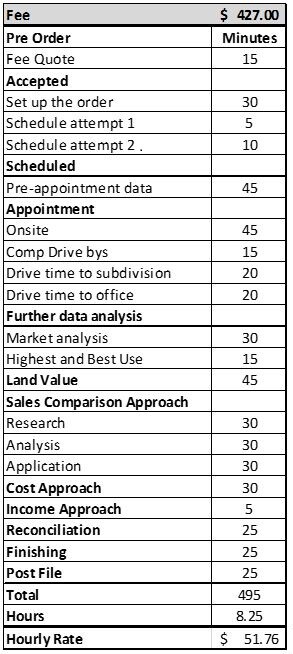

So what am I trying to do here, besides make everyone want a BLT? I want to dig in briefly to look at what really goes into a properly written appraisal report. Not from a technical perspective, only appraisers will really understand that, but from a business perspective. I think if we break down each step in the process and look at the actual time needed, those outside looking in may see the same problem those of us on the inside see every day. So let us look at a typical AMC-sourced appraisal order in my area. First, let us make a couple of assumptions so everyone has perspective on the example. I am going to assume this is a standard property type in the area, that it is an FHA appraisal, that a business week is an acceptable turnaround time, and that the fee being paid is customary and reasonable per the Virginia Tech residential appraiser fee survey: $427.

- Pre Order:

- Most AMCs send over a pre-assignment solicitation asking us to provide a fee quote and turnaround time. This requires the appraiser to look up the property which entails often looking at the tax card, any previous listing, GIS maps, etc. to ascertain the possible complexity of the assignment. It also requires the appraiser to consider the current workload and then provide the quote back to the AMC in writing.

- Accepted:

- If the appraiser is awarded the assignment it must be processed and setup within the software. This takes time, as the order must be placed into the appraisal report software, all tax records and MLS records must be pulled, deed information, etc.

- The property contact must be called to set up. For this example we are going with two attempts, with the second being a successful contact and spending a few minutes agreeing on a time, a few minutes answering questions, and a few minutes asking the borrower questions about the property. Sometimes these phone calls can take half an hour or more if the contact has lots of questions or the appraiser may need to ask lots of questions if it is an unusual property.

- Scheduled: more data gathering and the beginning of the data analysis

- All busy appraisers will try to maximize time and effort by doing as much work ahead of time as possible. This will include pulling as much data together as possible so that the reporting process is enhanced for speed and accuracy. Let us assume this is a normal assignment in a large subdivision with plenty of recent sales, and the appraiser has recently done some reports on other properties in the subdivision.

- The appraiser must recheck the zoning information to make sure it is a legal use and compare the plat or GIS map of the subject to make sure the home is utilizing the lot properly (encroachment issues, setback issues, etc.). Hopefully the borrower was able to give the appraiser an idea of condition, recent upgrades or repairs made, so the appraiser has some idea of condition.

- The appraiser must check the data from the tax records with that of any previous listing data on the subject.

- The appraiser will pull possible comparable sales and listings based on gathered information thus far.

- All busy appraisers will try to maximize time and effort by doing as much work ahead of time as possible. This will include pulling as much data together as possible so that the reporting process is enhanced for speed and accuracy. Let us assume this is a normal assignment in a large subdivision with plenty of recent sales, and the appraiser has recently done some reports on other properties in the subdivision.

- Appointment

- Assuming the property is as expected, the appointment may take as little as 25 minutes onsite or as much as an hour or more. Considering many borrowers have questions or want to have small talk, let us go with 45 minutes. Remember, the appraiser is measuring the property improvements to sketch them, taking notes, looking in the attic, the crawl space, and making sure the utilities are all on and mechanical systems appear to be functioning (all the while dealing with the dog, crawling through bushes and the weather).

- While in the neighborhood, most appraisers will go ahead and drive by all the comparable properties that are of relevance to the assignment. Let us assume the appraiser is going to use four sales and two active listings. The appraiser already has recently driven by and photographed three of the six, so only three drive-bys are needed.

- This is a typical scenario, but often enough, the comparable properties selected may not be appropriate because the condition of the property is different from expected, the subject property may have an addition the borrower forgot to mention and the tax assessor has yet to add to the property card, etc.

- Further data analysis: this is assuming the appraiser has done recent work on similar properties

- Market analysis (MA)

- There is a six-step market analysis that should be performed.

- Highest and Best Use (HBU)

- There are four applicable tests that must be applied twice once as if vacant and the other as improved.

- This is a simple procedure if the subject property is in good condition, recently built and appeals to the market. It gets much more in depth and consumes time if the subject is atypical or is an older home where consumers prefer newer amenities, etc.

- There are four applicable tests that must be applied twice once as if vacant and the other as improved.

- Market analysis (MA)

- Land Value

- Syncing with the previous step, the appraiser should develop an opinion of value for the land component.

- This takes as comparable sales must be reviewed if available, or some other alternative technique is required. Either way it takes some time.

- Syncing with the previous step, the appraiser should develop an opinion of value for the land component.

- Sales Comparison Approach

- Each of the properties used in this analysis (remember there are six, but three have already been researched) must be researched, this requires e-mail or phone calls to the agents involved (possibly the title company/attorney that closed it). This will often lengthen out because agents are hard to get in touch with or some information is skewed.

- Analysis must be performed (this normally is a data set of information not limited to just the selected comparable properties).

- Application of methods/techniques for developing an opinion of value.

- Cost Approach

- The first method we use is some sort of cost service like Marshall & Swift.

- There are many others.

- Cost comps is a methodology using recently-built homes to develop a market extracted cost.

- Both methods require a depreciation estimate which is derived like both options for cost (book and/or market extraction).

- The first method we use is some sort of cost service like Marshall & Swift.

- Income Approach

- This approach is not applicable to this assignment because there are no rental comparables to develop the approach and the appraiser knows this so it is explained in the report and documented in the work file.

- Reconciliation

- This is the final step before formatting and proofing the report.

- Each approach used must be explained and applied to the final opinion of value.

- Finishing the report and sending out

- Most AMCs require the use of some type of web portal to upload the report.

- They want XML and PDF formats, if not also ENV formats, of the report.

- An invoice must also be processed and uploaded.

- Most AMCs require the use of some type of web portal to upload the report.

- Post File/Revision Requests

- Most AMCs will come back with some sort of revision request. Many are correctly asked for but lots of them are not.

It is obvious from this list that lots of things go into the process of dealing with a typical, run of the mill report. In most cases, this example, at least in my experience, is hardly ever the case. Most of my assignments will require multiple trips to look at additional comparables, or the subject property is not an ideal improvement for the market. I may work in a neighborhood where rentals are available and I have to look at and apply the income approach. There are myriad reasons why the process can be lengthening, and should be for due diligence reasons.

Almost $52.00 an hour sounds great but that is gross. The appraiser still has to attribute automobile costs, insurance (professional and otherwise), MLS costs, cost service fees, licensure fees, state and federal taxes, continuing education, etc. Add to that the certification to be an appraiser now requires a four-year degree plus about two-to three years of professional educational and experience to even get licensed, all of a sudden that $52/hour becomes something marginally less.

Many appraisers can and do make relatively good incomes, but they work hard to do it. Which is why laws like what Virginia just passed are needed. Many AMCs want to hire appraisers at $200 or even less to do the same amount of work, and they get what they pay for because many of the steps I have reviewed are not performed. This places the borrower and lender at risk because established minimal practice is ignored in order to meet the low fee.

Bravo Virginia, hopefully some other states will follow suit.

.png)

.png)

-1.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

-1.png)