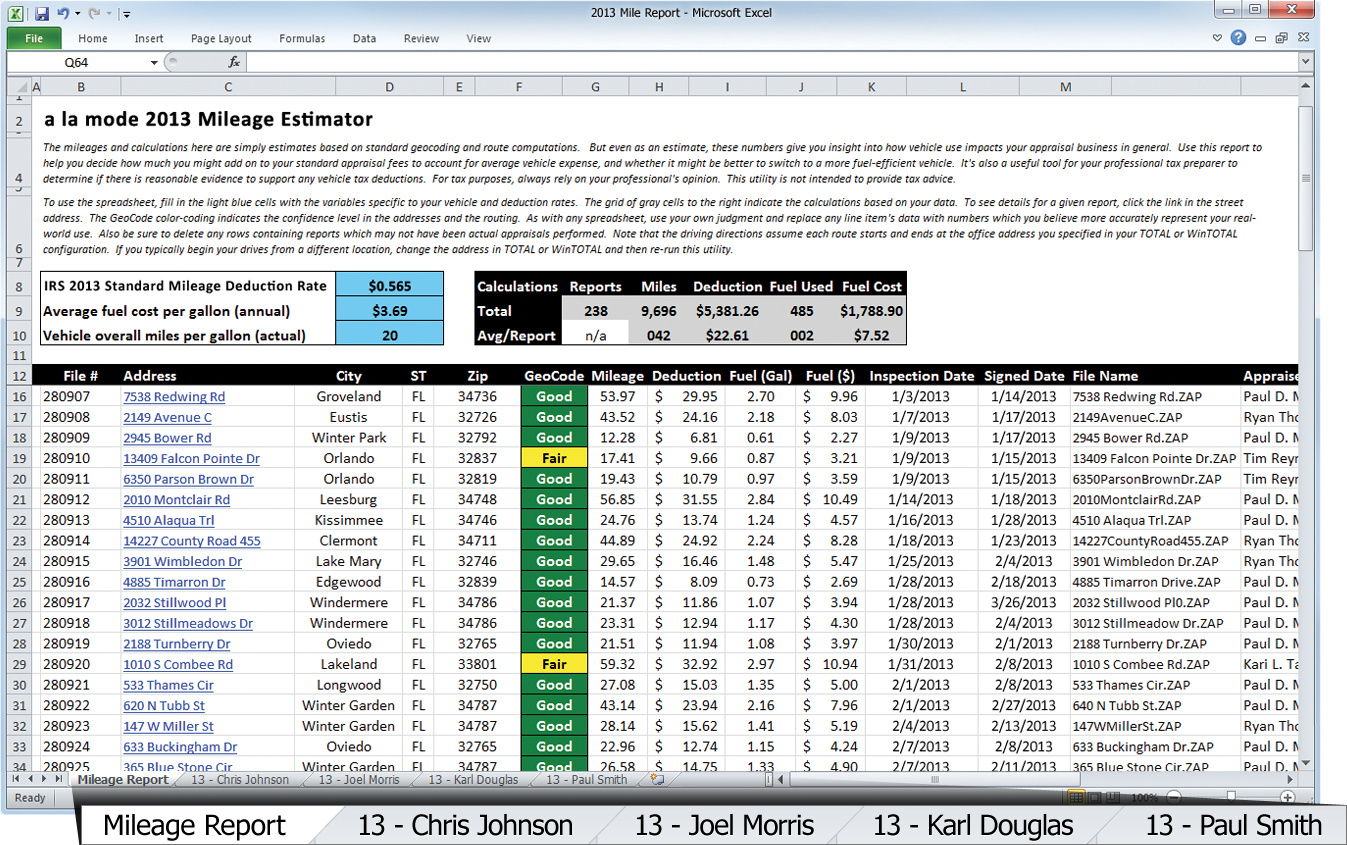

We introduced the 2012 edition of Mileage Estimator this spring with instantly popularity. And we just released the 2013 version today. It turns your entire 2013 WinTOTAL and TOTAL databases of signed or inspected reports into a customizable spreadsheet with mileage totals, fuel consumption, fuel expense, and even vehicle tax deduction estimates.

The idea came from years of talking to so many of you that keep handwritten logs and boxes of receipts to track mileage. It’s very tedious and error-prone, and tax time is made even more stressful if you’re relying solely on these for estimates. But more importantly, because everything is so manually tracked and noted, it’s nearly impossible to use the expenses to help you make real business decisions all year round. You need to know what your drive time really costs.

After all, your vehicle expenses inevitably become a hot issue at tax time, but they should be evaluated constantly. They help you with adjusting fees, choosing your next vehicle, evaluating coverage areas, and even forecasting your expenses and cashflow. Mileage Estimator helps you answer all of these questions without sifting through papers or breaking out the calculator. That’s why it was so popular this spring. And of course, the spreadsheets can be used as estimates when working with your accountant during tax season.

So, we just released Mileage Estimator for 2013. And we turned the feedback you gave us into four new features:

- Calculate mileage reports for 2013

We’ve updated Mileage Estimator to provide mileage reports based on the standard 2013 deduction rate per mile driven provided by the IRS (rather than 2012 rates). In addition, reports include estimates based on the national average price of gallon of fuel. Of course, because it’s all in a spreadsheet, you’ll want to adjust fuel cost to be reflective of your area too. The IRS figures are a good starting point though. - Create reports for each appraiser

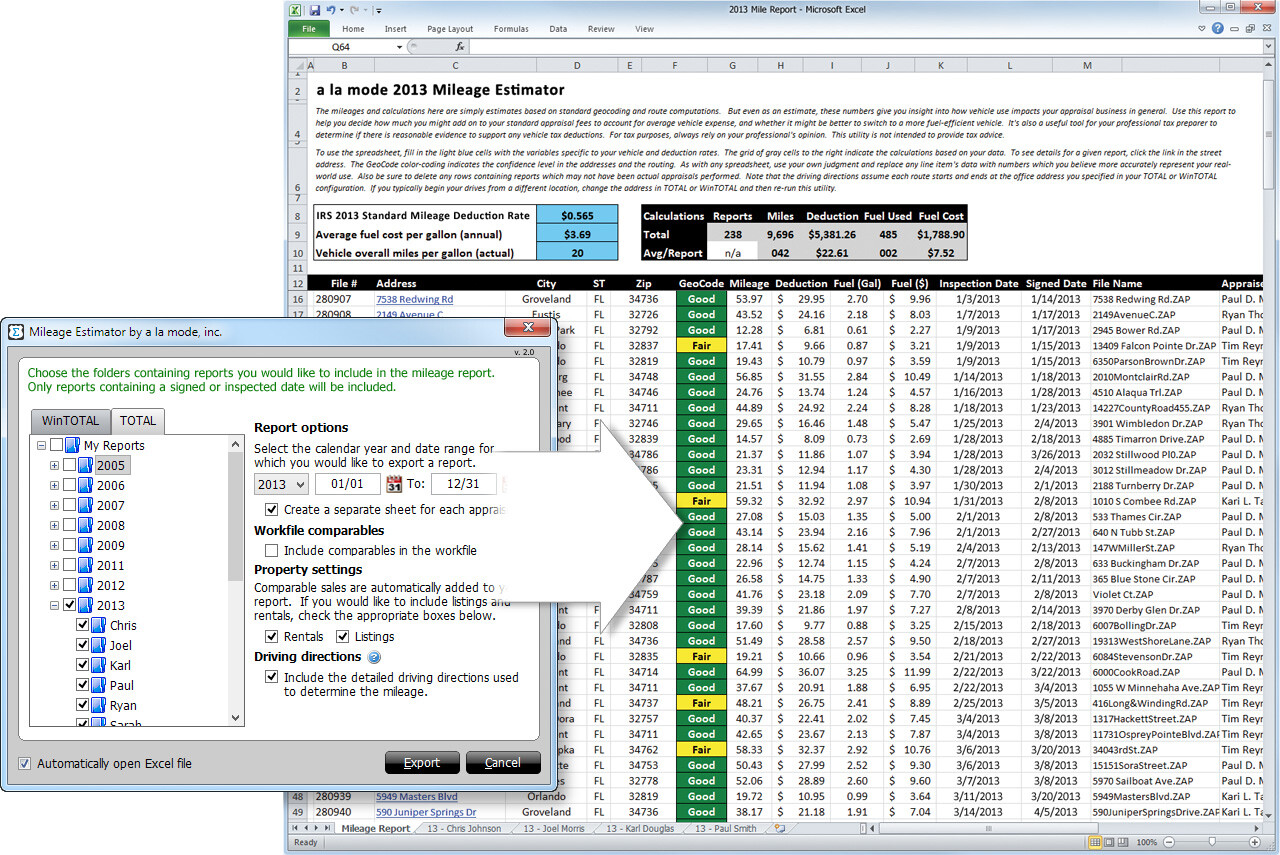

Now you can create mileage reports for all appraisers in your office or on an individual basis. It’s extremely valuable for larger offices or even if there are just two of you. In the first tab of the report, you’ll see the combined estimates and the additional tabs break it all out for each person.

- Generate reports for the full year or a specific date range

Mileage Estimator allows you to create mileage reports for the entire year or for any date range within the calendar year. You can create daily, weekly, monthly, quarterly, or custom-date mileage reports, which will be very helpful when comparing mileage expense from one period to another. - Include unused comps from the Workfile

Usually, you drive out to comps that don’t make it into your report. So we’ve added an option to include all of the comps in your Workfile in the estimates. That way, you’ll have much more realistic figures to work from. (See how to add comps that don’t make the cut to your Workfile automatically here.)

These excellent additions to Mileage Estimator make it even more useful – all year round.

And here’s another: If you own Mileage Estimator 2012, Mileage Estimator 2013 can include appraisal reports from 2012 as well. This way, you can pinpoint any changes in mileage over the year or on specific date ranges (maybe you spent more in gas this October than last and need to adjust fees).

Plus, all the features in the 2012 version of this product can still be found in the 2013 version – listings and rentals, providing driving directions, etc.

At only $39, you can’t go wrong. All of the data is pulled straight from TOTAL and/or WinTOTAL, so everything is done in a few clicks. The timesavings alone are worth $39, and you may find that you can justify an annual increase in you fees. Your tax pro will probably be very appreciative too – when tax time comes around, send your estimates to them.

The 2013 version is ready for purchase and download now. Click here to learn more about it and buy it now. Or give us a call at 1-800-ALAMODE. You can also watch the new video below to see how it works.

.png)

.png)

-1.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

-1.png)